Last week's coffee market chart (2025-09-22 to 2025-09-28)

The market was a bit calm last week! Between September 22nd and 28th, coffee prices were moving smoothly, as if they were relaxing in the sun in the park.

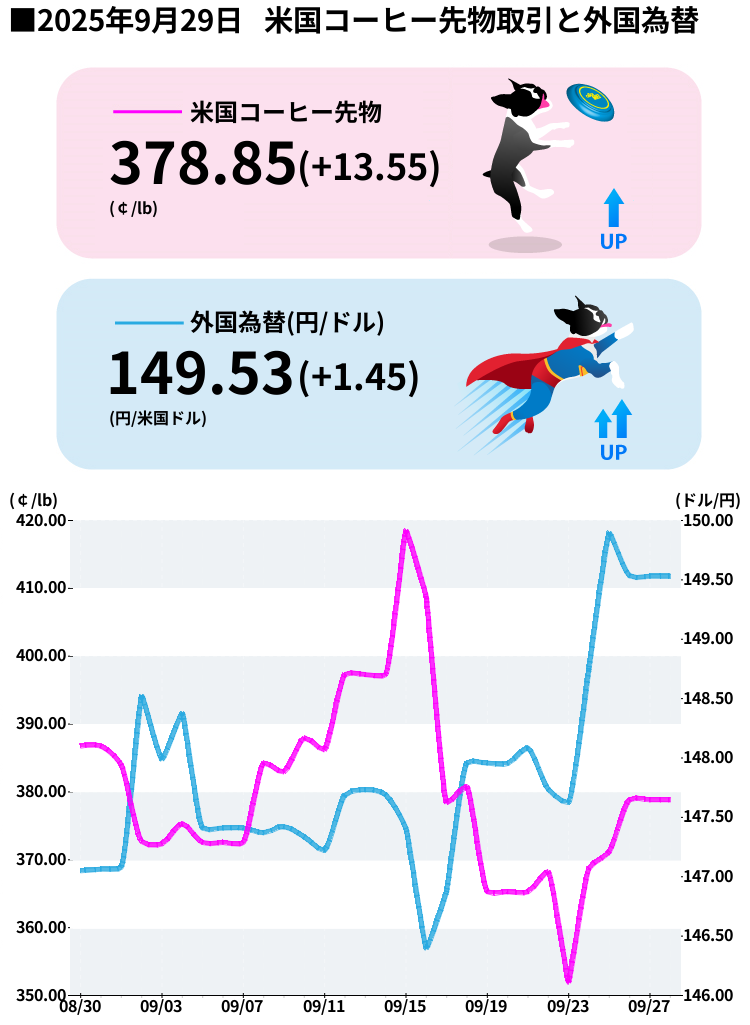

At first, it started off a little low, then gradually rose as if sniffing, giving off a positive scent from around 368.25 to 371.20.

Especially from the 25th to the 26th, it seemed as if it was chasing a ball, rushing towards higher prices, reaching a sweet spot of 378.85.

However, overall, there weren't many big waves or sudden drops like the previous week, so it felt light and safe.

It was fun watching him wag his tail and watch his daily movements! I'm looking forward to seeing what happens next!

At first, it started off a little low, then gradually rose as if sniffing, giving off a positive scent from around 368.25 to 371.20.

Especially from the 25th to the 26th, it seemed as if it was chasing a ball, rushing towards higher prices, reaching a sweet spot of 378.85.

However, overall, there weren't many big waves or sudden drops like the previous week, so it felt light and safe.

It was fun watching him wag his tail and watch his daily movements! I'm looking forward to seeing what happens next!

Why was he so calm? Even a dog can tell

Several key factors contributed to this week's relatively calm market. First and foremost, rain finally began falling in Brazil's Minas Gerais state ! The region reportedly recorded 25.9 mm of rain in late September, 104% of the historical average. September is the crucial flowering period for coffee plants, and rain at this time feels like a treat! The market breathed a sigh of relief as the extreme dryness that had continued since April finally eased. However, it may still be too early to relax. On September 16, the National Oceanic and Atmospheric Administration (NOAA) raised the likelihood of a La Niña event occurring between October and December to 71% . La Niña is like a sudden big puddle on a walking trail, bringing excessive dryness to Brazil and potentially negatively impacting the 2026/27 harvest. Next, we want to focus on the sudden decline in ICE-certified inventory ! On September 24th and 25th, it was reported that Arabica coffee inventories had fallen to a 17.5-month low of 601,717 bags . This felt like a favorite snack being removed from the shelves, creating a sense of anxiety throughout the market that there might be shortages! The impact of the 50% tariff on Brazilian coffee imposed by the United States is gradually being felt in the market. The tariff was imposed for political reasons, and American roasters have begun to avoid new contracts for Brazilian coffee, further tightening U.S. supplies. Brazil accounts for roughly one-third of U.S. coffee imports, so this is a big change!There's good news and bad news.

Good news (wagging tails): Rain has finally started falling in Brazil, finally rehydrating coffee trees! The moderate rainfall, especially during the flowering period, bodes well for next season's harvest. Vietnam's 2025/26 coffee production is expected to increase 6% year-on-year to 1.76 million tons (29.4 million bags) , marking its highest level in four years. Bad news (flat ears): However, on September 4, Brazil's National Food Supply Company (CONAB) revised its 2025 Arabica coffee production forecast downward by 4.9% to 35.2 million bags . Reports of a prolonged drought that lasted from April to September have stressed coffee trees, causing them to lose leaves and experience reduced productivity. This is similar to the feeling of a dog slumped over after a long day of playing in the park. Additionally, industry analysts Volcafé predict that the global Arabica coffee supply shortfall will reach 8.5 million bags in 2025/26, which is expected to expand from the 5.5 million bags recorded in 2024/25. This will mark the fifth consecutive year of supply shortages, which could lead to continued upward pressure on prices in the long term.The yen and dollar were in a relaxed mood.

Looking at the foreign exchange market, the USD/JPY showed relatively stable movements during the week of September 22nd to 28th. For the month of September as a whole, the USD/JPY rose approximately 0.52% from 147.037 yen at the beginning of the month to 147.928 yen at the end . The weekly high was 149.957 yen on September 26th and the weekly low was 145.485 yen on September 17th, suggesting that the period from September 22nd to 28th saw a relatively narrow range. During this period, the yen weakened slightly against the dollar, but there were no major fluctuations. It's like a dog walking with its owner, maintaining a comfortable distance. Just as the coffee market was calm, the foreign exchange market was also in a relaxed mood. The strength of the US economy and expectations for monetary policy may have been behind the rise in the US dollar. However, the Japanese yen also did not weaken excessively, and its movements were balanced!This week's walking course (points to note)

This week, the dogs will summarize the key points to watch! 1. Brazil's weather patterns : The most important question is whether the rainy season will fully begin. If the dry weather continues, the market could enter a state of anxiety again. 2. ICE inventory trends : Will inventories, which have fallen to their lowest level in 17.5 months, continue to decline or recover? This will be a major factor in determining price direction. 3. US tariff policy : President Trump's executive order on September 5th suggested that coffee may be exempt from tariffs in the future as a "natural resource not sufficiently produced in the United States," but the 50% tariff on Brazilian coffee remains in place. It will be interesting to see if there are any changes to this policy. 4. Vietnam's production situation : There are reports of delays in the Robusta coffee harvest due to typhoons and heavy rain. Vietnam is the world's largest Robusta producer, so any issues here could affect the global market. 5. The occurrence of the La Niña phenomenon : Will La Niña, which is predicted to occur between October and December with a 71% probability, actually occur? This will be a big challenge for Brazil.Next week's predictions (with full dog intuition)

Now, let's take a look at my own predictions for the market next week and beyond! Bullish Scenario (Tail Wagging): If the expected rain in Brazil doesn't fall sufficiently or if ICE inventories continue to decline, prices are likely to resume an upward trend. They could even move toward the year-end peak of 424 cents/lb, recorded on September 16th . In particular, if signs of a La Niña phenomenon strengthen, speculative buying could come in and prices could move in a range of 390-410 cents/lb . Bearish Scenario (Ears Flat): On the other hand, if rain continues to fall smoothly in Brazil and production in Vietnam recovers, supply concerns could ease and prices could enter a correction phase. Furthermore, if the U.S. eases or exempts tariffs, market sentiment could improve dramatically. In that case, we can expect prices to move in a range of 360-375 cents/lb . Technically , last week's high of 378.85 is likely to act as short-term resistance. A break above this level would signal an uptrend, while a break below would signal a correction. The support line is likely to be set around 368.25! As for the foreign exchange market, unless there are major changes in the monetary policy stance of Japan and the US, it is likely to remain stable in the 146-150 yen range. However, if there are any surprising economic indicators or policy announcements, sudden fluctuations are possible, so we must remain vigilant! Overall, this week may have been the "calm before the storm." As we enter October, Brazil's weather patterns will become clearer, and harvest forecasts should become more accurate. There may be another big movement there, so we'll have to keep a close eye on things! *Invest at your own risk, so be careful and keep your tail up!

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function