Last week's coffee market chart (2025-09-29 to 2025-10-05)

Woof woof! Here's an analysis of the coffee market from September 29th to October 3rd, 2025!

Last week's market was like a dog chasing a ball on its walk ! It started the week feeling a little down, but quickly recovered and finished at a high price with its tail wagging !

Prices fluctuated throughout the week, but ultimately made a big recovery from the start of the week . On September 30th, there was a small rise, and we were like, "Wow! We did it!" From October 1st, the market was in full swing, heading towards new highs again! On the 2nd, there was a bit of a break, and it seemed to be tucking its tail in, but on the 3rd, it jumped back into high gear, hitting a happy high over the weekend !

Why was he so energetic? 5 reasons even your dog can understand

1. Brazil's severe drought continues <br />Brazil is experiencing its worst drought in 70 years . In particular, in Minas Gerais, the main coffee-producing state, there was almost no rain from April to September, with many farms experiencing severe conditions with no rain for as long as 120 to 130 days . This is causing great damage to coffee trees, and it is said that this will affect the 2025/26 harvest.

2. ICE certified stock is rapidly decreasing.

The main reason for the price increase is the rapid decline in ICE-certified inventory from August to September. The impact of the 50% tariff imposed by the US on Brazilian coffee has led to a rapid decline in US inventory. As of mid-September, Arabica inventory had fallen to approximately 570,000 bags , the lowest level in 1.5 years ! When inventory is low, people panic and buy, fearing they might not have enough coffee, which causes prices to rise.

3. Worries about Brazil's flowering season

September is the crucial flowering period for Brazilian coffee trees. If there isn't enough rain during this time, next year's harvest will be significantly reduced. Rainfall in Minas Gerais state was reported to be only 73% of the historical average for the week of September 20th. It appears there was some rain over the weekend, but the situation remains worrisome.

4. The likelihood of a La Niña event is increasing. On September 16, the National Oceanic and Atmospheric Administration (NOAA) raised the probability of a La Niña event occurring between October and December to 71% . If this occurs, it could bring excessive dryness to Brazil, further damaging the 2026/27 coffee harvest.

5. Production forecasts revised down significantly <br /> Leading coffee industry analyst Volcafe has revised down its forecast for Brazil's Arabica production in 2025/26 by approximately 11 million bags from its September forecast to 34.4 million bags . This shows the severity of the drought. Furthermore, the global Arabica shortage is predicted to be 8.5 million bags , marking the fifth consecutive year of shortage !

There's good news and bad news.

Good News

Rain is reported to have started falling in Brazil over the weekend. The week ending September 27th saw rainfall of 104% of the historical average in the state of Minas Gerais. This could be good news for coffee plants!

Bad News

However, experts are concerned that "even though the rains have started, the damage already done may not be repairable ." Many trees have lost their leaves, and even if they do flower, they may not bear fruit. Also, with the 50% US tariff still in place, tension in the market remains high.

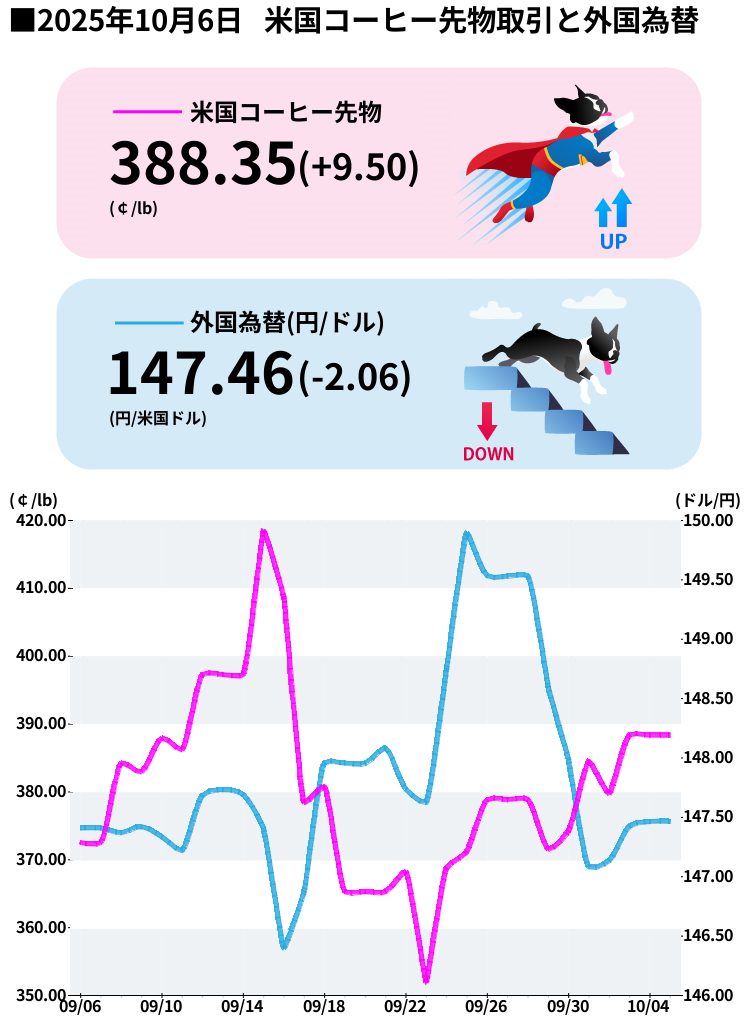

The yen and dollar were in a relatively stable mode.

The USD/JPY exchange rate this week fluctuated between 147 and 148 yen . The closing price on September 30th was 147.93 yen . Looking at the whole of September, it was a relatively stable exchange rate, rising only 0.52% from 147.17 yen at the beginning of the month to 147.93 yen at the end of the month.

The yen continues to weaken, but it's not as dramatic as the rise in coffee prices, so it may be a double whammy for Japanese importers . Coffee is getting more expensive in dollar terms, and the yen is also weaker, so it's even more expensive when you look at it in Japanese yen terms!

This week's walking course (points to note)

1. Check the Brazilian weather forecast every day

The flowering period will continue into October, so the rainfall situation in Brazil is extremely important. If it rains, prices may temporarily settle down, but if it doesn't, they may rise further.

2. ICE inventory trends <br />If inventory continues to decrease, upward pressure on prices will continue. Conversely, if inventory starts to increase, it may be a sign of price adjustments.

3. U.S.-Brazil tariff negotiations

Whether or not the 50% tariff will be eased will be huge news for the market. If there is progress in the negotiations, prices may plummet.

4. Vietnam's weather and Robusta production. With Arabica prices soaring, there is a possibility that demand for Robusta as an alternative will increase. Vietnam's production situation is also worth keeping an eye on.

5. Speculators' positions are changing

I check the COT report (Commodity Futures Trading Commission position report) to see how much speculators are buying. If the buying is too large, there may be a sudden correction.

Next week's predictions (with my dog's intuition at full force)

[Bullish scenario: The tail is wagging and it's going up!]

If there is not enough rain in Brazil and ICE stocks fall further, prices could rise another 5-10% and head towards the $3.20-$3.40 range per pound . Technically, the upward trend is strong, so if speculators buy, it could rise even more!

[Weak scenario: Time for a break, poof]

On the other hand, if Brazil receives a good amount of rain and the flowering season ends safely, a sense of relief will spread, and prices may adjust to $2.80-$3.00 . However, the fundamentals are still bullish, so a major drop is unlikely.

[Dog's true feelings predictions]

Personally, I think prices will fluctuate in the $3.00 to $3.20 range . Considering the severity of the drought and the declining inventory, there is little reason for a significant drop, but if there is some rain, there could be a temporary adjustment. However, I think that prices are likely to remain high in the long term !

Technically, $3.00 is an important support line . If it breaks below this level, further declines are possible, but given the current market sentiment, I think this line is strong. On the other hand , if it breaks above $3.35, there is a possibility of a new uptrend !

*Invest at your own risk, be careful and wag your tail! This article is for informational purposes only and does not constitute investment advice. The market can move unexpectedly, so always check multiple sources of information!

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function