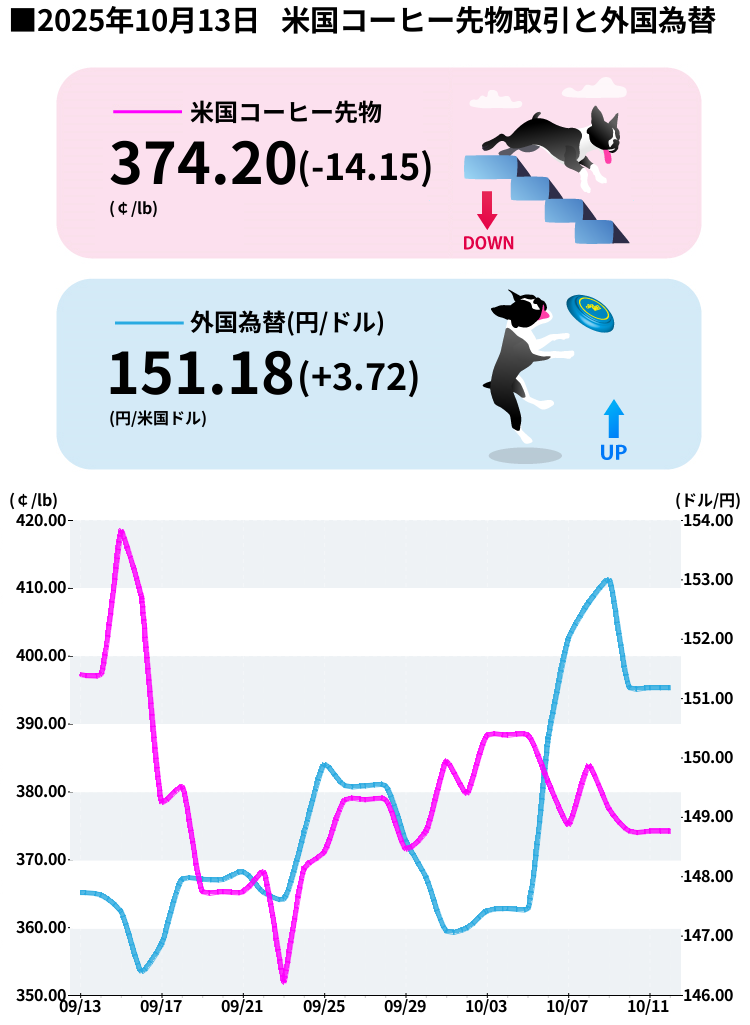

Last week's coffee market chart (2025-10-06 to 2025-10-12)

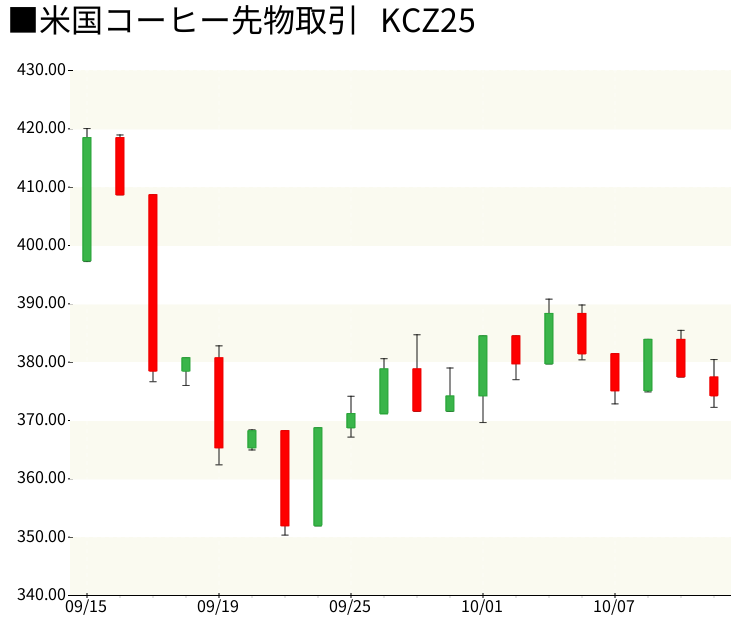

The week from Monday, October 6th to Friday, October 10th, 2025 , was like a dog that suddenly got tired in the middle of playing with a ball! At the start of the week, it was running around energetically at a high price of around $385 , but by the middle of the week, it gradually ran out of steam and eventually fell to $375.40 . Compared to the previous week, it was down about -2.5% , which was a bit disappointing.

Monday, October 6th, was the start of the week, and the market was in an excited mood, starting at the $385 range . There was some hope that the price might rise further due to the impact of the drought in Brazil and the 50% US tariff. However, from Tuesday, October 7th to Wednesday, October 8th, the price gradually declined, dropping to $375.40 on October 8th . This was a drop of -1.55% , and it is said that buying pressure temporarily eased due to rumors in the market that "tariff negotiations between Brazil and the US may be progressing."

Although it recovered slightly on Thursday, October 9th and Friday, October 10th, it ended its walk down by nearly $10 from the week's high. Looking at the percentage change since the beginning of the year, it is still up more than +55% , so in the long term, Dawan continues to be in a bullish trend. However, in the short term, it seems to have taken a break.

Why am I so out of breath? Even my dog knows the reason

The reason for the price drop this week is that there were some "big smells" in the market.

1. Hopes for Brazil-US tariff negotiations

In mid-October, Brazilian Foreign Minister Vieira and U.S. Secretary of State Rubio met in Washington. Expectations spread in the market that the 50% tariff might be eased . These tariffs, which have been in effect since August 2025, impose an additional 50% tariff on coffee imported by the U.S. from Brazil. This has led to U.S. importers canceling or postponing new contracts for Brazilian coffee. The market thought that if the tariffs were lifted, supply concerns would ease and prices might fall.

2. ICE-certified stocks continue to fall sharply. <br />However, there are also bullish factors supporting prices. As of October 7, Arabica stocks under ICE supervision had fallen to 534,665 bags , the lowest level in 1.5 years ! Robusta stocks had also fallen to 6,237 lots , the lowest level in 2.5 months . Due to the 50% tariff, imports to the US have plummeted, and stocks are rapidly decreasing. Decreasing stocks mean "lower snack stockpiles," which makes prices more likely to rise.

3. Brazil's Drought Intensifies <br />Brazil is currently experiencing the most severe drought in 70 years . In early October, Minas Gerais, Brazil's largest Arabica producing state, saw only 0.9mm of rainfall in the week leading up to October 4th . This is only 3% of the average! The drought has delayed the flowering of coffee trees and caused them to lose their leaves, leading to a predicted significant reduction in the 2025/26 harvest. Brazil's agricultural forecasting agency, Conab, has revised down its 2025 Arabica production to 35.2 million bags , a 4.9% reduction from its previous forecast.

4. 71% Chance of La Niña Occurrence <br />The US National Oceanic and Atmospheric Administration (NOAA) has raised the probability of a La Niña event occurring between October and December to 71% . La Niña could bring even drier weather to Brazil, raising concerns that it could negatively impact the 2026/27 crop.

5. Hopes for a recovery in Vietnam's production <br />There are some slightly bearish factors. Vietnam, the world's largest producer of Robusta, is expected to produce 1.76 million tons (29.4 million bags) in 2025/26, up 6% from the previous year . This is the highest level in four years, and the increased supply of Robusta may also be affecting Arabica prices.

There's good news and bad news.

【Good News🎾】

If tariff negotiations progress, supply concerns may ease and prices may stabilize. Also, the long-term trend has been strong, with over +55% since the beginning of the year , so investors feel like they can still go further.

Bad news 😰

However, if Brazil's drought continues, the 2025/26 harvest is likely to be significantly smaller, Wang said. Experts at Volcafé predict that the Arabica supply shortfall will reach 8.5 million bags , marking the fifth consecutive year of shortages , Dawan said. With inventories also plummeting, there's a risk that even a little bad news could send prices soaring.

The yen and dollar were in a "slightly bullish" mood.

In the foreign exchange market this week, USD/JPY fluctuated in the range of 150 to 153 yen . As of October 6th, 1 dollar was around 150.28 yen , but in the middle of the week, it rose to the 153 yen range. This is because the dollar strengthened slightly, and the yen weakened.

A stronger dollar means that coffee import prices from the Japanese perspective will rise. For example, coffee that costs $375 per pound, calculated at 150 yen per pound, would cost about 82,500 yen per pound, but at 153 yen per pound, it would be about 84,375 yen per pound, or about 2.3% higher , said Dawan. A weaker yen would pose a tough situation for Japanese coffee importers and roasters, Dawan said.

The reason for the yen's depreciation this week is said to be the relatively high interest rates in the US and the fact that Japan's monetary policy remains accommodative. There was a strong view in the market that the Bank of Japan would not make any major interest rate hikes yet.

This week's walking course (points to note)

Here's a summary of the points to look out for next week (October 13th to October 17th)!

1. Rainfall in Brazil <br />This is the most important point! Whether it rains in the states of Minas Gerais and São Paulo will have a major impact on the mood of the market. If it rains, the flowers will flower and prices may fall. On the other hand, if the drought continues, prices will rise again.

2. Progress in tariff negotiations <br />Attention will be focused on whether negotiations between Brazil and the US will make concrete progress. If news emerges that tariffs will be eased, prices could drop sharply. Conversely, if negotiations stall, supply concerns could reignite and prices could rise.

3. ICE inventory trends <br />Inventories have fallen to 534,665 bags, so it's important to see whether they will continue to fall further or whether tariff easing will lead to a slight recovery. If inventories continue to fall, prices will be supported.

4. Vietnam Export Data <br />It's also important to check whether Vietnam's exports are increasing steadily. If the supply of Robusta increases, it could have an impact on Arabica.

5. USD/JPY Exchange Rate <br />It will also be important to watch whether the yen continues to weaken. If the yen weakens to the 154-155 yen range, it will become even more difficult for Japanese coffee importers.

6. October US employment statistics and FOMC-related announcements

There is a possibility that US economic indicators will be released in mid-October, which will affect the strength of the dollar. If the dollar strengthens, the yen will weaken, which will indirectly affect coffee prices.

Next week's predictions (with my dog's intuition at full force)

[Bullish scenario🚀]

If Brazil's drought worsens and rainfall remains unpredictable, prices could rise again to the $390-$400 range. Also, if ICE inventories continue to decline, supply concerns may resurface and buying may intensify. Technically, a break above $380 could resume the uptrend.

[Bearish Scenario📉]

On the other hand, if tariff negotiations between Brazil and the US progress and news of tariff easing emerges, prices could fall to the $360-$370 range . Also, unexpected rainfall in Brazil could ease market anxiety and drive prices lower. Technically, if prices break below $370 , there's a chance they could fall further.

[Dog's predicted range]

Next week (October 13th to October 17th), Wang predicts prices will fluctuate in the range of $370 to $395 , with the central price around $380 . The direction of the price fluctuations will depend on tariff negotiations and the weather in Brazil.

In the long term, a supply shortage is expected in 2025/26, so I think the downside is limited . However, in the short term, there is a possibility that prices will fluctuate significantly depending on the news, so careful risk management is important!

*Invest at your own risk, be careful and wag your tail!

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function