Last week's coffee market chart (2025-10-13 to 2025-10-19)

For the week of October 13th to October 19th, 2025 , the coffee futures market continued to rise like a dog chasing a ball in the park! From the beginning to the end of the week, Arabica coffee prices showed strong movements, making the dog's tail wag.

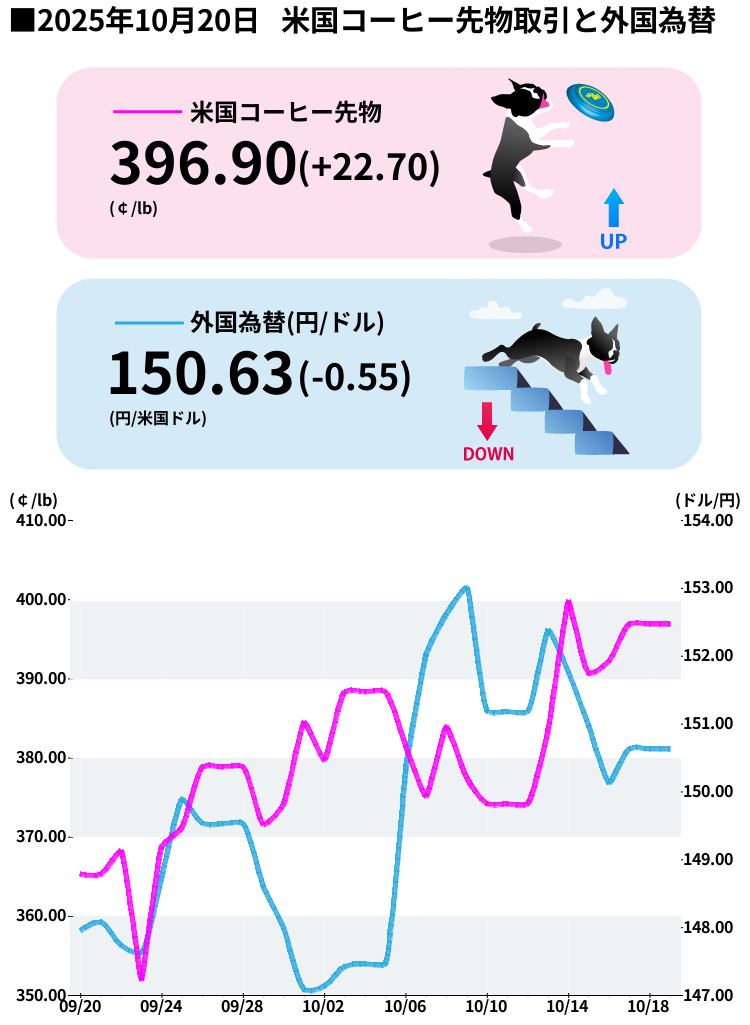

This week, Dawan surprised the market by hitting a high of $399.80/lb on October 14th ! Later in the week, on October 17th, it rose to $396.90 , a 0.79% increase from the previous day. Looking at the month, coffee prices have risen by 4.21% , and are a whopping 55.20% higher than the same period last year! This makes me feel like I've been given three snacks!

Why is he so energetic? Even dogs can understand the reason

There were several key reasons for this week's price increase. First and foremost, ICE-certified inventories continue to decline . As of October 7, Arabica inventories were reported to have fallen to a 1.5-year low of 534,665 bags . This is like a bag of snacks running empty, and the market is panicking.

And what's worrying everyone is the drought in Brazil . Brazil, the world's largest producer of Arabica coffee, is experiencing its most severe drought in 70 years , with the main producing state of Minas Gerais reporting only 0.9mm of rainfall in the first week of October. This is an astonishingly low amount, just 3% of the average! Brazil's agricultural forecasting agency, Conav, has revised its 2025 Arabica coffee production forecast downward by 4.9% to 35.2 million bags .

Additionally, the 50% US tariff on Brazilian coffee is having a major impact. Because of this tariff, American buyers are canceling new contracts from Brazil, tightening supplies to the US market. Since roughly one-third of the pre-roasted coffee consumed in the US comes from Brazil, this is a big problem!

Another concern is the likelihood of a La Niña event occurring. The National Oceanic and Atmospheric Administration (NOAA) has reported that the probability of a La Niña event occurring between October and December has been raised to 71% . If this occurs, it could bring further dryness to Brazil, which could negatively impact the 2026/27 crop, Dawan said.

There's good news and bad news.

The good news: For producers, higher prices are translating into increased incomes. Colombia is also benefiting from its best harvest in 30 years, Dawan said. The specialty coffee market also has bright prospects in the long term, projected to grow to $183 billion by 2030.

The bad news: Increasing robusta coffee supplies from Vietnam could put downward pressure on arabica prices, says Wang. Brazil's harvest is nearly complete, meaning new supply could enter the market, says Da Wan. High prices could also dampen demand, with some analysts predicting prices could fall 8-30% by the end of 2025.

The yen and dollar were in a sideways mode.

In the foreign exchange market, the USD/JPY showed relatively stable movements. As of October 17, the exchange rate was around 150.50 yen , almost flat, up 0.10% from the previous day . Over the past month, the yen has weakened 1.72% , while the dollar has remained slightly stronger.

Compared to the huge rise in the coffee market, the exchange rate has been in a "slow and steady" mode. However, the yen's continued depreciation has caused a double whammy for Japanese importers, with rising coffee prices and increasing exchange costs.

This week's walking course (points to note)

- Rainfall situation in Brazil: We are currently in flowering season, so whether or not it rains will determine the fate of the 2026/27 crop. I have to check it every day!

- ICE inventory trends: If inventory decreases further, prices may rise further. Keep an eye on this!

- US tariff negotiations: It appears that there was a meeting between the Brazilian Foreign Minister and Secretary of State Rubio, and if tariffs are eased, Dawan says prices may be adjusted.

- Vietnam export data: Continued increase in Robusta coffee supply may affect the overall market.

- Speculators' movements: How fund positions change also affects short-term price movements, says Dawan.

Next week's predictions (with my dog's intuition at full force)

Bullish scenario: If the drought in Brazil continues and ICE inventories fall further, prices could head towards the $400-$410/lb range. Prices could surge, especially if reports emerge that La Niña is having a stronger impact.

Bearish Scenario: If the US-Brazil tariff negotiations progress or unexpected rainfall hits Brazil, prices could adjust to $380-$390/lb . Also, if a decline in demand due to high prices is confirmed, downward pressure could intensify.

Most likely scenario: My hunch is that the price will trade in a range of $390-$405/lb . Fundamentals remain bullish, but I think this is a level where short-term profit-taking is likely. Technically, the key will be whether the price can break through the $399.80 resistance.

As for USD/JPY, Dawan predicts a range of 149-152 yen . This will depend on the Bank of Japan's monetary policy and US economic indicators, but he doesn't expect any major fluctuations.

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function