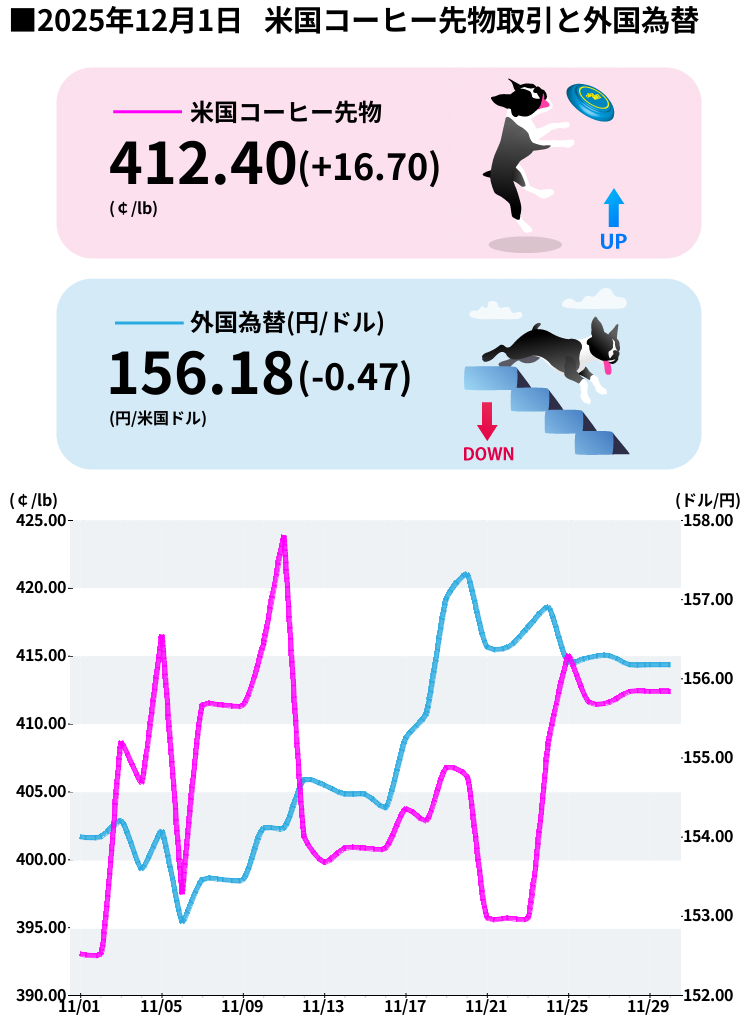

Last week's coffee market chart (2025-11-24 to 2025-11-30)

Woof woof! Here's the coffee futures report for November 24th-29th!

Last week's market saw some solid movement, like a dog chasing a ball in the park!

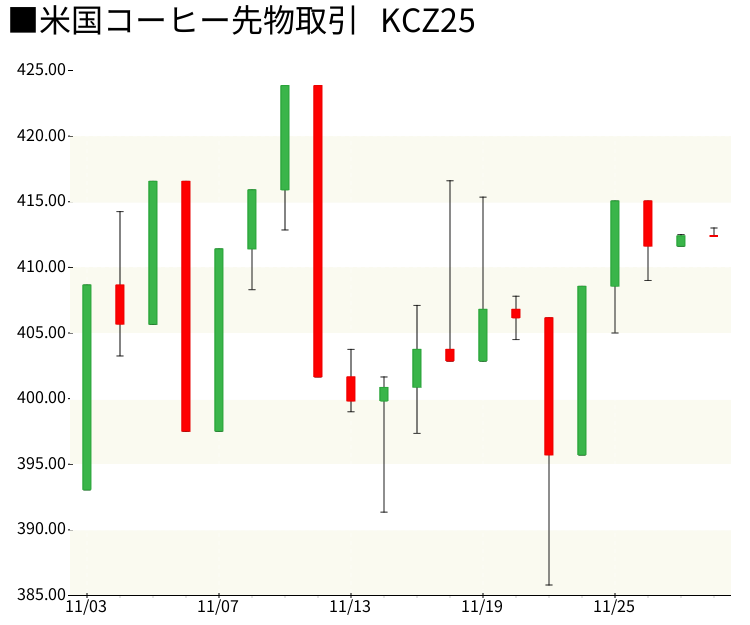

The stock price plummeted following the news last Friday (11/21) that President Trump would lift tariffs on Brazil, but has since recovered strongly.

It started at $395.70 on November 24th and rose to $412.40 by the weekend of the 28th!

It was a strong jump of +5.55% over the week and +27.67% over the same period last year!

As a result of the happy tail wagging, the price steadily rose.

The number of buyers increased, and the atmosphere was like everyone getting excited and playing together!

1. Buyback Rush After Tariff Elimination

On November 21st, President Trump completely eliminated the 40% tariff on Brazilian coffee!

Immediately after the announcement, the stock price fell to $359.25 (a sharp drop of more than 6%), but traders who felt this was a bargain immediately began buying it back.

Prices recovered rapidly on the hope that the removal of tariffs would normalize Brazilian coffee supplies to the US!

2. Drought continues in Brazil <br />But the fundamental supply concerns remain.

According to Somar Meteorologia, rainfall in Minas Gerais, Brazil's largest Arabica producing state, for the week ending November 21st was 26.4mm , only 49% of the historical average.

Dry conditions continue at a critical time during the 2026/27 flowering period, which may have an impact on next season's harvest.

3. ICE certified inventory at historic lows

ICE-certified Arabica stocks have fallen to a 1.75-year low of 398,645 bags !

Robusta stocks are also at their lowest level in 6.25 months (4,911 lots), and physical supply remains tight.

4. Brazilian Real Strengthens <br />On Friday, the Brazilian real hit its highest level against the dollar in a week.

A strong real will discourage Brazilian producers from exporting, putting upward pressure on coffee prices.

5. Heavy rains in Vietnam delay harvest <br />In Vietnam, the world's largest producer of Robusta, heavy rains have continued in Dak Lak Province, delaying the harvest.

This is supporting Robusta prices and indirectly spreading to Arabica.

◎ Good news (tail wagging!)

- The elimination of US tariffs on Brazil paves the way for normalization of trade!

- The tariff elimination will be retroactive to November 13th, and any tariffs already collected will be refunded.

- StoneX forecasts Brazilian production to reach 70.7 million bags in 2026/27 (up 29% year-on-year).

✕ Bad news (depressing...)

- Brazil's drought remains severe, with the driest conditions in 70 years

- Volcafe predicts Arabica deficit of -8.5 million bags in 2025/26 (fifth consecutive year of deficit)

- The 50% tariff on US instant coffee is still in place.

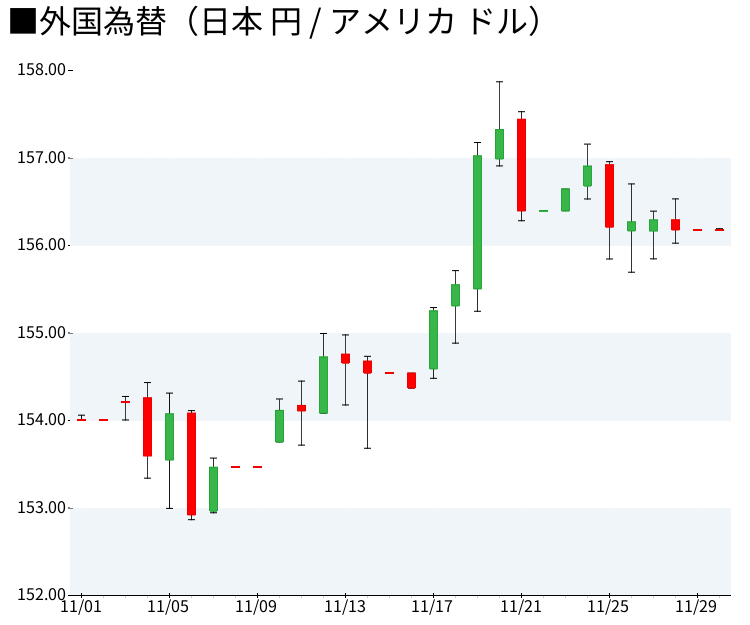

USD/JPY trended towards a weaker yen last week.

On November 24th, the yen hit a weekly high of 157.075 yen , and then strengthened to 155.825 yen on November 25th.

By the weekend of the 28th, it had settled at around 156.05 yen .

The yen has weakened by 2.17% over the month and 4.16% over the year, continuing its downward trend.

The highest price in 2025 was 158.35 yen on January 8th, and the lowest price was 140.72 yen on April 21st.

The trend of a strong dollar and a weak yen will increase costs for Japanese companies that import coffee in yen.

1. Rainfall in Brazil :

Keep an eye on Somar Meteorologia's weekly report.

If the rain returns from late November, it will have a positive effect on flowering in 2026/27.

2. Trends in ICE certified inventory :

It will be important to keep an eye on whether inventory remains below 400,000 bags.

There are also reports of 150,000 bags of Brazilian Arabica being shipped to a European warehouse.

3. Vietnam Harvest Progress :

We want to see how long the harvest delay caused by the heavy rain will last and what impact it will have on Robusta prices.

4. Update on US tariff policy :

Keep an eye on the possibility of further easing of the 50% tariff on instant coffee.

5. Trends in the Brazilian Real :

If the real rises, it will support prices, but if it falls, increased exports will put downward pressure on prices.

6. December contract expiry date approaching :

Be careful of position adjustments as the contract month changes.

◎ Bullish scenario (full throttle!)

If the drought in Brazil continues and further declines in ICE inventories are confirmed, prices could head towards $420-430 !

If the real continues to rise, exports will be curtailed, tightening supply, and it is possible that the currency may re-test its all-time high of $440.85, reached in February.

✕ Bearish scenario (a bit depressing)

If sufficient rainfall is confirmed in Brazil and expectations for a recovery in production next fiscal year increase, prices may adjust to the $380-390 range.

If exports from Brazil to the US increase sharply due to the elimination of tariffs, inventory will be replenished, which will put downward pressure on prices.

Estimated Range: $385-$425

Technically, $400 is seen as a support line.

However, the weather risk remains high and there is a possibility of big changes depending on the news, so let's be careful and keep our tails wagging!

*Invest at your own risk, be careful and wag your tail!

[Data source]

- Trading Economics (price data)

- Barchart (market analysis/Somar rainfall data)

- Investing.com (Historical Data)

- Wise/Exchange-rates.org (currency data)

- Daily Coffee News (Tariff Elimination News)

- Reuters / Bloomberg (market news)

- Nasdaq (fundamental analysis)

- Rabobank (Brazilian Coffee Monthly Report)

Last week's market saw some solid movement, like a dog chasing a ball in the park!

The stock price plummeted following the news last Friday (11/21) that President Trump would lift tariffs on Brazil, but has since recovered strongly.

It started at $395.70 on November 24th and rose to $412.40 by the weekend of the 28th!

It was a strong jump of +5.55% over the week and +27.67% over the same period last year!

As a result of the happy tail wagging, the price steadily rose.

The number of buyers increased, and the atmosphere was like everyone getting excited and playing together!

Why did it go up so much? Even a dog can understand the reason

1. Buyback Rush After Tariff Elimination

On November 21st, President Trump completely eliminated the 40% tariff on Brazilian coffee!

Immediately after the announcement, the stock price fell to $359.25 (a sharp drop of more than 6%), but traders who felt this was a bargain immediately began buying it back.

Prices recovered rapidly on the hope that the removal of tariffs would normalize Brazilian coffee supplies to the US!

2. Drought continues in Brazil <br />But the fundamental supply concerns remain.

According to Somar Meteorologia, rainfall in Minas Gerais, Brazil's largest Arabica producing state, for the week ending November 21st was 26.4mm , only 49% of the historical average.

Dry conditions continue at a critical time during the 2026/27 flowering period, which may have an impact on next season's harvest.

3. ICE certified inventory at historic lows

ICE-certified Arabica stocks have fallen to a 1.75-year low of 398,645 bags !

Robusta stocks are also at their lowest level in 6.25 months (4,911 lots), and physical supply remains tight.

4. Brazilian Real Strengthens <br />On Friday, the Brazilian real hit its highest level against the dollar in a week.

A strong real will discourage Brazilian producers from exporting, putting upward pressure on coffee prices.

5. Heavy rains in Vietnam delay harvest <br />In Vietnam, the world's largest producer of Robusta, heavy rains have continued in Dak Lak Province, delaying the harvest.

This is supporting Robusta prices and indirectly spreading to Arabica.

Good news and bad news

◎ Good news (tail wagging!)

- The elimination of US tariffs on Brazil paves the way for normalization of trade!

- The tariff elimination will be retroactive to November 13th, and any tariffs already collected will be refunded.

- StoneX forecasts Brazilian production to reach 70.7 million bags in 2026/27 (up 29% year-on-year).

✕ Bad news (depressing...)

- Brazil's drought remains severe, with the driest conditions in 70 years

- Volcafe predicts Arabica deficit of -8.5 million bags in 2025/26 (fifth consecutive year of deficit)

- The 50% tariff on US instant coffee is still in place.

The yen and the dollar were in a weak yen mode.

USD/JPY trended towards a weaker yen last week.

On November 24th, the yen hit a weekly high of 157.075 yen , and then strengthened to 155.825 yen on November 25th.

By the weekend of the 28th, it had settled at around 156.05 yen .

The yen has weakened by 2.17% over the month and 4.16% over the year, continuing its downward trend.

The highest price in 2025 was 158.35 yen on January 8th, and the lowest price was 140.72 yen on April 21st.

The trend of a strong dollar and a weak yen will increase costs for Japanese companies that import coffee in yen.

This week's walking course (points to note)

1. Rainfall in Brazil :

Keep an eye on Somar Meteorologia's weekly report.

If the rain returns from late November, it will have a positive effect on flowering in 2026/27.

2. Trends in ICE certified inventory :

It will be important to keep an eye on whether inventory remains below 400,000 bags.

There are also reports of 150,000 bags of Brazilian Arabica being shipped to a European warehouse.

3. Vietnam Harvest Progress :

We want to see how long the harvest delay caused by the heavy rain will last and what impact it will have on Robusta prices.

4. Update on US tariff policy :

Keep an eye on the possibility of further easing of the 50% tariff on instant coffee.

5. Trends in the Brazilian Real :

If the real rises, it will support prices, but if it falls, increased exports will put downward pressure on prices.

6. December contract expiry date approaching :

Be careful of position adjustments as the contract month changes.

This week's predictions (including my dog's intuition)

◎ Bullish scenario (full throttle!)

If the drought in Brazil continues and further declines in ICE inventories are confirmed, prices could head towards $420-430 !

If the real continues to rise, exports will be curtailed, tightening supply, and it is possible that the currency may re-test its all-time high of $440.85, reached in February.

✕ Bearish scenario (a bit depressing)

If sufficient rainfall is confirmed in Brazil and expectations for a recovery in production next fiscal year increase, prices may adjust to the $380-390 range.

If exports from Brazil to the US increase sharply due to the elimination of tariffs, inventory will be replenished, which will put downward pressure on prices.

Estimated Range: $385-$425

Technically, $400 is seen as a support line.

However, the weather risk remains high and there is a possibility of big changes depending on the news, so let's be careful and keep our tails wagging!

*Invest at your own risk, be careful and wag your tail!

[Data source]

- Trading Economics (price data)

- Barchart (market analysis/Somar rainfall data)

- Investing.com (Historical Data)

- Wise/Exchange-rates.org (currency data)

- Daily Coffee News (Tariff Elimination News)

- Reuters / Bloomberg (market news)

- Nasdaq (fundamental analysis)

- Rabobank (Brazilian Coffee Monthly Report)

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function