Last week's coffee market chart (2025-10-27 to 2025-11-02)

Woof woof! We bring you the coffee futures and exchange rate report for October 27th to November 2nd, 2025!

Last week's market felt like I was going for a walk and gradually climbing a hill.

Wang started the week at $388.90 on Monday, rose gradually to $389.60 on Tuesday and $392.00 on Wednesday.

And on Saturday, the weekend ended with a closing price of $393.05 ! That was a +1.07% increase for the week.

But the most exciting day was the start of the next week, Monday (November 3rd)!

It jumped to $408.69 in one go, a huge jump of +4.24% from the previous day !

It's like when you find a new ball you love, and the market just jumps on it.

There are several key reasons for this rise.

The first thing to note is that ICE certified stock has dropped dramatically !

As of November 1st, that figure had fallen to 431,481 bags , the lowest level in 1.75 years .

It was as if there were no snacks left in the park, and everyone started to panic, saying, "We have to get some quickly!"

Next, Wang was worried about the weather in Brazil.

In the week ending October 24th, Minas Gerais state saw only 0.3mm of rain, just 1% of average .

It was extremely dry and the coffee plants were thirsty.

The following week (until October 31st) saw 33.4mm of rain, bringing the temperature back down to 75% of the average , but it's still not enough.

And the 50% tariff imposed by the United States on Brazilian coffee continues to have a major impact.

The tariffs have caused Brazilian exports to the US to plummet by more than 80% .

This is a really big problem, as about a third of the coffee consumed in the United States comes from Brazil, so it really puts a strain on supply.

On October 29th, the US Senate passed a resolution to lift the tariffs by a vote of 52 to 48 , but the tariffs are still in place.

There's talk that the meeting between President Lula and President Trump might lead to a resolution soon, but the honest truth is, we won't know until we see.

Good news:

The good news is that it's starting to rain in parts of Brazil.

However, this doesn't mean the problem is completely solved, but it does mean that the situation is gradually improving.

Leading analyst Volcafe also forecasts a global Arabica coffee supply shortfall of 8.5 million bags in the 2025/26 fiscal year.

This marks the fifth consecutive year of supply shortages, which is a major factor supporting prices.

The bad news (or rather the worrying news):

The fact that the US tariff issue has not yet been resolved is a real concern.

I don't know when it will be resolved, and it may drag on for a long time.

Also, according to NOAA, there's a 71% chance that a La Niña event will occur between October and December .

If this happens, it could bring extreme dryness to Brazil, potentially negatively impacting the 2026/27 harvest.

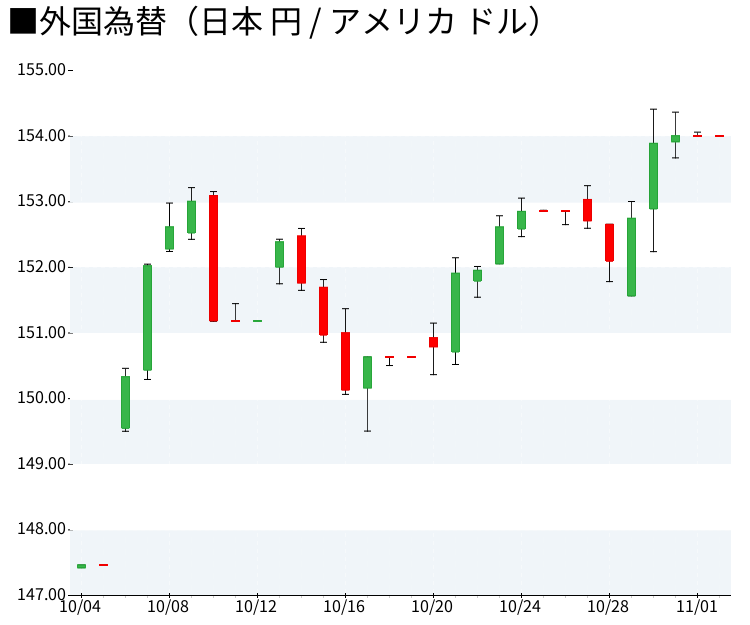

In the foreign exchange market, USD/JPY was fluctuating between the 153 yen and 154 yen range .

The yen remained relatively stable, at 154.18 yen on October 31st and 153.99 yen on November 1st.

The dollar has been a little strong, which can sometimes be a bit of a headwind for coffee prices, but this time supply concerns were stronger, so prices rose despite the strong dollar.

It was as if it was moving forward with its tail wagging even in a headwind!

1. US-Brazil tariff negotiations :

This is the most important point! If tariffs are abolished, prices may drop suddenly, so be careful.

2. Weather forecast for Brazil :

It will be extremely important to see if it continues to rain. I'll be checking the Somar Meteorologia and Climatempo reports every week.

3. ICE inventory trends :

It has already fallen to its lowest level in 19.5 months, so it will be interesting to see whether it will continue to fall or rebound.

4. Vietnam export data :

Robusta coffee exports from Vietnam are on the rise, so it will be interesting to see how this affects the Arabica market.

5. Key analyst reports :

Be sure to check the latest reports from Volcafe, Rabobank, and StoneX. November is the month when new production forecasts are released, so be sure to pay close attention.

Hmm, this is a tough one... but to be honest, I remain bullish in the short term !

[Bullish scenario (probability around 60%)]

If the tariff issue isn't resolved anytime soon and ICE stock continues to decline, the price could rise to around $410-$425 .

In particular, if rainfall in Brazil decreases again or concerns about the La Niña phenomenon increase, prices could jump sharply.

Technically, having broken through the psychological milestone of $400 on the weekly chart, the next target is around $420 .

If we can break through this point, it looks like we'll be able to aim even higher.

[Bearish scenario (probability around 40%)]

If the US and Brazil suddenly agree to remove tariffs, prices could fall to around $380-$390 .

This is a strange situation where prices fall despite good news, but the market has already factored in supply concerns, so sometimes prices are sold off when the problem is resolved.

Additionally, if Brazil continues to receive sufficient rain and the 2026/27 harvest outlook improves, this could also push prices down.

[Exchange rate outlook]

We expect USD/JPY to move in the range of 152 yen to 156 yen .

It will fluctuate depending on US economic indicators and the Bank of Japan's monetary policy, but unless there are any major surprises, it is likely to remain relatively stable.

[Dog's final advice]

There's a bit of tension in the market right now, like when you suddenly encounter a big dog while out for a walk.

The "big dog" of supply insecurity is still lurking around, so we need to be careful of sudden price movements.

If you are trading in the short term, a good strategy might be to buy when it falls below $390 and lock in some profits when it exceeds $420 .

I think it would be a good idea for long-term investors to wait for the tariff issue to be resolved and then buy when the price drops to the $380 range .

But we mustn't forget that the coffee market can move drastically with unexpected news.

So it's important to keep your position size appropriate and set your stop loss properly.

*Invest at your own risk, be careful and wag your tail!

---

[Data source]

- ICE Futures: Certified Inventory Data

- Somar Meteorologia / Climatempo: Brazilian weather data

- Trading Economics / Investing.com: Price Data

- Barchart / Nasdaq: Market Analysis

- Volcafe / Rabobank / StoneX: Analyst Report

- United States Department of Agriculture (USDA): Production forecast data

- International Coffee Organization (ICO): Import and export data

Last week's market felt like I was going for a walk and gradually climbing a hill.

Wang started the week at $388.90 on Monday, rose gradually to $389.60 on Tuesday and $392.00 on Wednesday.

And on Saturday, the weekend ended with a closing price of $393.05 ! That was a +1.07% increase for the week.

But the most exciting day was the start of the next week, Monday (November 3rd)!

It jumped to $408.69 in one go, a huge jump of +4.24% from the previous day !

It's like when you find a new ball you love, and the market just jumps on it.

Why are you so energetic? Even your dog can tell

There are several key reasons for this rise.

The first thing to note is that ICE certified stock has dropped dramatically !

As of November 1st, that figure had fallen to 431,481 bags , the lowest level in 1.75 years .

It was as if there were no snacks left in the park, and everyone started to panic, saying, "We have to get some quickly!"

Next, Wang was worried about the weather in Brazil.

In the week ending October 24th, Minas Gerais state saw only 0.3mm of rain, just 1% of average .

It was extremely dry and the coffee plants were thirsty.

The following week (until October 31st) saw 33.4mm of rain, bringing the temperature back down to 75% of the average , but it's still not enough.

And the 50% tariff imposed by the United States on Brazilian coffee continues to have a major impact.

The tariffs have caused Brazilian exports to the US to plummet by more than 80% .

This is a really big problem, as about a third of the coffee consumed in the United States comes from Brazil, so it really puts a strain on supply.

On October 29th, the US Senate passed a resolution to lift the tariffs by a vote of 52 to 48 , but the tariffs are still in place.

There's talk that the meeting between President Lula and President Trump might lead to a resolution soon, but the honest truth is, we won't know until we see.

There's good news and bad news.

Good news:

The good news is that it's starting to rain in parts of Brazil.

However, this doesn't mean the problem is completely solved, but it does mean that the situation is gradually improving.

Leading analyst Volcafe also forecasts a global Arabica coffee supply shortfall of 8.5 million bags in the 2025/26 fiscal year.

This marks the fifth consecutive year of supply shortages, which is a major factor supporting prices.

The bad news (or rather the worrying news):

The fact that the US tariff issue has not yet been resolved is a real concern.

I don't know when it will be resolved, and it may drag on for a long time.

Also, according to NOAA, there's a 71% chance that a La Niña event will occur between October and December .

If this happens, it could bring extreme dryness to Brazil, potentially negatively impacting the 2026/27 harvest.

The yen and dollar were in "bullish dollar" mode.

In the foreign exchange market, USD/JPY was fluctuating between the 153 yen and 154 yen range .

The yen remained relatively stable, at 154.18 yen on October 31st and 153.99 yen on November 1st.

The dollar has been a little strong, which can sometimes be a bit of a headwind for coffee prices, but this time supply concerns were stronger, so prices rose despite the strong dollar.

It was as if it was moving forward with its tail wagging even in a headwind!

This week's walking course (points to note)

1. US-Brazil tariff negotiations :

This is the most important point! If tariffs are abolished, prices may drop suddenly, so be careful.

2. Weather forecast for Brazil :

It will be extremely important to see if it continues to rain. I'll be checking the Somar Meteorologia and Climatempo reports every week.

3. ICE inventory trends :

It has already fallen to its lowest level in 19.5 months, so it will be interesting to see whether it will continue to fall or rebound.

4. Vietnam export data :

Robusta coffee exports from Vietnam are on the rise, so it will be interesting to see how this affects the Arabica market.

5. Key analyst reports :

Be sure to check the latest reports from Volcafe, Rabobank, and StoneX. November is the month when new production forecasts are released, so be sure to pay close attention.

Next week's predictions (with full dog intuition)

Hmm, this is a tough one... but to be honest, I remain bullish in the short term !

[Bullish scenario (probability around 60%)]

If the tariff issue isn't resolved anytime soon and ICE stock continues to decline, the price could rise to around $410-$425 .

In particular, if rainfall in Brazil decreases again or concerns about the La Niña phenomenon increase, prices could jump sharply.

Technically, having broken through the psychological milestone of $400 on the weekly chart, the next target is around $420 .

If we can break through this point, it looks like we'll be able to aim even higher.

[Bearish scenario (probability around 40%)]

If the US and Brazil suddenly agree to remove tariffs, prices could fall to around $380-$390 .

This is a strange situation where prices fall despite good news, but the market has already factored in supply concerns, so sometimes prices are sold off when the problem is resolved.

Additionally, if Brazil continues to receive sufficient rain and the 2026/27 harvest outlook improves, this could also push prices down.

[Exchange rate outlook]

We expect USD/JPY to move in the range of 152 yen to 156 yen .

It will fluctuate depending on US economic indicators and the Bank of Japan's monetary policy, but unless there are any major surprises, it is likely to remain relatively stable.

[Dog's final advice]

There's a bit of tension in the market right now, like when you suddenly encounter a big dog while out for a walk.

The "big dog" of supply insecurity is still lurking around, so we need to be careful of sudden price movements.

If you are trading in the short term, a good strategy might be to buy when it falls below $390 and lock in some profits when it exceeds $420 .

I think it would be a good idea for long-term investors to wait for the tariff issue to be resolved and then buy when the price drops to the $380 range .

But we mustn't forget that the coffee market can move drastically with unexpected news.

So it's important to keep your position size appropriate and set your stop loss properly.

*Invest at your own risk, be careful and wag your tail!

---

[Data source]

- ICE Futures: Certified Inventory Data

- Somar Meteorologia / Climatempo: Brazilian weather data

- Trading Economics / Investing.com: Price Data

- Barchart / Nasdaq: Market Analysis

- Volcafe / Rabobank / StoneX: Analyst Report

- United States Department of Agriculture (USDA): Production forecast data

- International Coffee Organization (ICO): Import and export data

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function