Last week's coffee market chart (2025-11-10 to 2025-11-16)

Woof woof! Last week ( November 10th to November 16th, 2025 ) was a week of wild ups and downs for coffee futures prices, just like a dog on a roller coaster!

For the first half of the week, kids were running around the park excitedly, thinking, "Maybe we'll find some snacks!", but suddenly, in the middle of the week, the big news came in: "What?! There will be more snacks!?", and the market was shocked and astonished.

In the end, it was a very exciting week, filled with a mixture of excitement and anxiety!

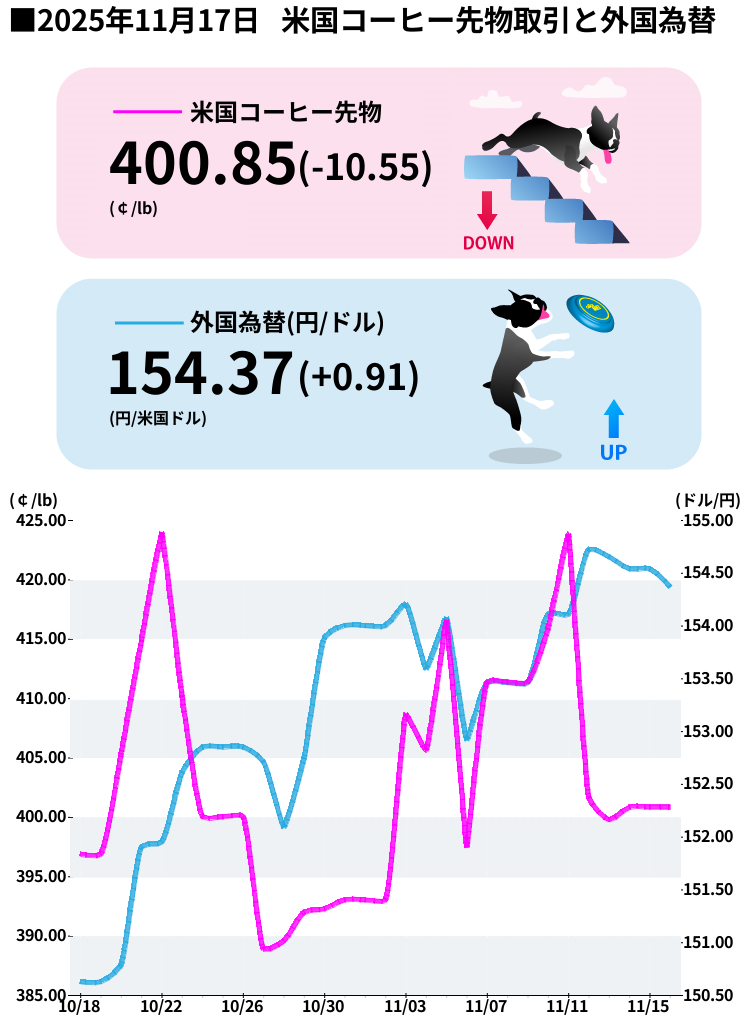

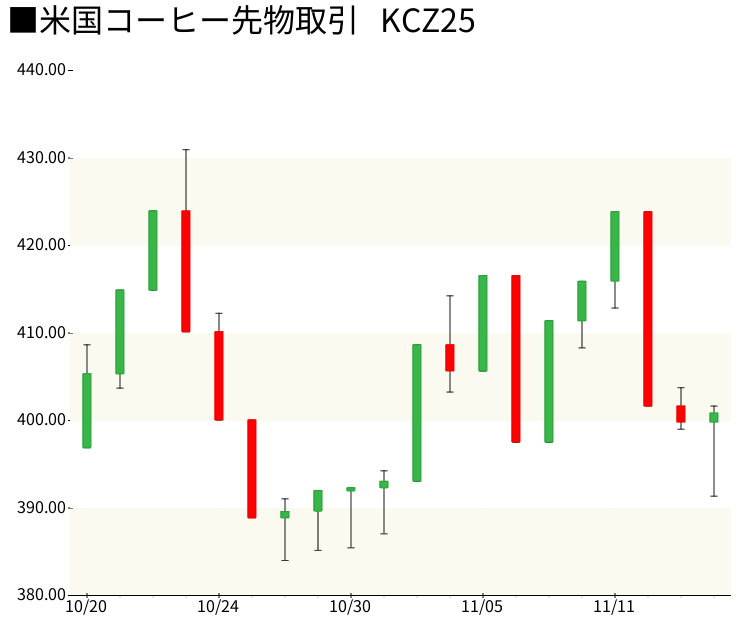

At the start of the week, on Monday, November 3rd , ICE Arabica Coffee futures (December contract) rose to 406.65 cents . This was the highest price in two weeks, and it felt like I had jumped over a high fence!

The rise was due to concerns about drought in Brazil and falling ICE stocks, which led to worries that "snacks are running low!"

However, a major incident occurred on Wednesday, November 12th !

President Trump and Treasury Secretary Bennett announced that they would lower tariffs on coffee.

With this announcement, coffee prices plummeted to 403.65 cents (-4.5% from the previous day) . This was a shock, like "The snacks I was looking forward to suddenly came down from the sky!"

On Thursday, November 14 , President Trump officially announced tariff reductions on beef, coffee, and tropical fruits.

The price on that day fluctuated around 400.85 cents , and on Friday, November 14th, it fell a further -1.90 cents (-0.47%) .

Looking at the week as a whole, the price fell by about 6-7 cents (about 1.5-1.7%) from 406.65 cents to around 400 cents , showing that the news of the tariff reduction had a major impact on the market.

1. Trump Administration Announces Tariff Reductions (Super Big News):

On Wednesday, November 12 , Treasury Secretary Bennett announced that the U.S. would "significantly reduce tariffs on products not grown in the United States (such as coffee and bananas)."

It was officially held the following day, Friday, November 14th .

Until now, Brazilian coffee has been subject to a 50% tariff , but this is expected to be relaxed, and the market has responded with excitement, saying, "Maybe supply will increase!"

However, although framework agreements have been announced with Argentina, Guatemala, El Salvador, and Ecuador, high tariffs still remain on imports from Brazil and Colombia (more than 50% of the total) .

2. Severe drought in Brazil:

Brazil, the world's largest coffee producer, is experiencing its worst drought since 2025 .

In particular, the state of Minas Gerais saw one week in late October when only 0.3mm of rain fell (1% of normal levels) .

Reports from November 13th indicate that some key weeks continue to see only 1% of normal rainfall .

The drought occurred during the flowering season and could have a serious impact on the 2026/27 harvest.

It's like not being able to drink water during a long walk, and the coffee plants are feeling quite stressed.

3. ICE inventories at historic lows:

ICE (Intercontinental Exchange) certified Arabica coffee stocks fell to approximately 406,129 bags as of November 11 , the lowest level in 1.75 years (approximately 21 months) .

As of November 3rd, the number was 431,481 bags, so that's a decrease of about 25,000 bags in just one week!

This means that there is almost no snack in stock, which would normally push up prices.

Wang said the main reason for the inventory decline was that American buyers canceled new contracts for Brazilian coffee due to the 50% US tariff.

4. Downward revision of Brazilian production forecast:

Brazil's crop forecasting agency Conab has revised down its 2025 Arabica production to 35.2 million bags , down 4.9% from its May forecast.

Meanwhile, trading firm Volcafe forecasts a global arabica deficit of 8.5 million bags for the 2025/26 season .

This marks the fifth consecutive year of supply shortages , and the market is feeling anxious that "snacks are getting scarcer and scarcer!"

5. Risk of La Niña:

The National Oceanic and Atmospheric Administration (NOAA) has raised the probability of La Niña occurring in the Southern Hemisphere between October and December to 71% .

La Niña could bring excessive dryness to Brazil, further threatening the 2026/27 coffee harvest.

Good News

Bad News

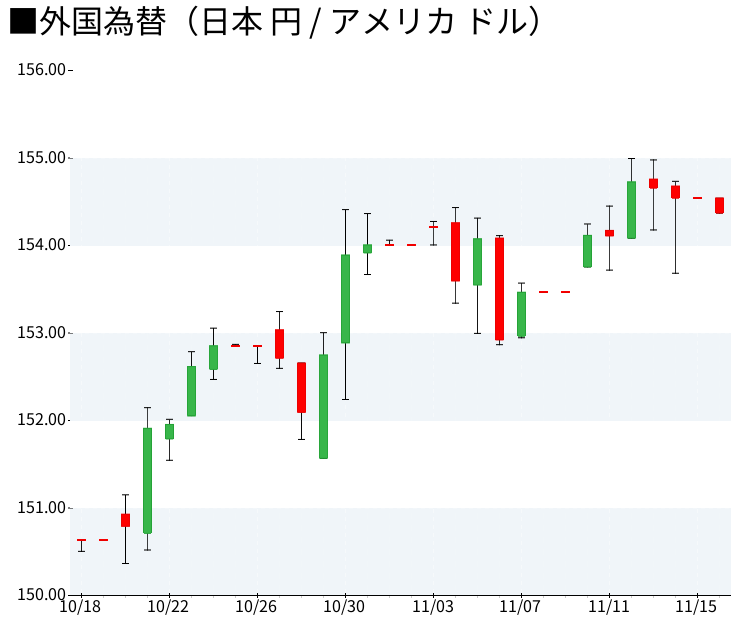

The USD/JPY exchange rate remained relatively stable.

On Monday, November 10th , it traded at 154.127 yen , and on Tuesday, November 11th, it fell to a weekly low of 153.78 yen .

The one then rose to a weekly high of 154.945 yen on Wednesday, November 13th .

The weekly range was 153.78 yen to 154.945 yen , a fluctuation of approximately 1.17 yen .

This was a gentle movement, like "slowly walking back and forth on a stroll," in contrast to the violent fluctuations in the coffee market.

Although the yen's depreciation trend continues, no major direction has emerged, and the market is in a "wait-and-see" mode, watching the developments in Japanese and US monetary policies and the global economy.

The fall in coffee prices is softened in yen terms, which may have provided a bit of a cushion for Japanese importers.

1. Actual effects of tariff reductions:

It will be important to keep an eye on how much the tariff reductions announced by the Trump administration will actually affect prices.

However, the effect may be limited, as high tariffs still remain on imports from Brazil and Colombia (more than 50% of the total).

2. Rainfall in Brazil:

Rainfall patterns in Minas Gerais over the next few weeks will have a major impact on the flowering period for the 2026/27 season.

Although the weather forecast is promising improvement, it remains a concern at this time.

3. ICE inventory trends:

The focus is on whether ICE inventories, which are at historically low levels, will decline further or be replenished by tariff cuts.

4. Supreme Court ruling:

The Supreme Court is expected to rule on the Trump administration's tariffs, which could have a major impact on future trade policy.

5. Volcafe's latest report:

Leading analyst firm Volcafe is likely to release an updated report on the Brazilian drought and its impacts.

6. Vietnam Robusta Production:

Vietnam's coffee production is forecast to grow 6% to 1.76 million tonnes (29.4 million bags) in 2025/26, Wang said.

It will also be interesting to see how the increased supply of Robusta will affect the Arabica market.

[Bullish scenario (420-430 cents)]

If rainfall in Brazil falls short of expectations and the drought worsens, markets could panic, with people thinking, "There really aren't enough snacks!"

Combined with the continued decline in ICE inventory, prices may test the 420-430 cent resistance zone.

If it becomes clear that the effects of tariff reductions are limited, there is a possibility that prices will return to an upward trend.

Bearish Scenario (380-390 cents)

If the impact of the tariff cuts is greater than expected and expectations of further policy easing grow, prices could fall to the support level of 380-390 cents .

Also, if there is more rain than expected in Brazil and the outlook for the 2026/27 harvest improves, selling pressure may increase on expectations that there may be more snacks available.

[Neutral scenario (400-410 cents)]

The most likely outcome is a flat movement within the 400-410 cent range.

The downward pressure from tariff cuts and the upward pressure from structural supply shortages are in balance, so the market is likely to continue in a "wait-and-see mode."

Fundamentals remain bullish, but policy uncertainty is likely to limit large price fluctuations in the short term.

[Foreign exchange market outlook]

We expect USD/JPY to move within the range of 153.50-155.50 yen .

Unless there are major changes in the monetary policies of Japan and the US, the current trend of a weak yen is likely to continue.

[Technical Analysis]

- Support levels: 380 cents, 390 cents, 395 cents

- Resistance levels: 410 cents, 420 cents, 430 cents

- Important pivot point: 400 cents (psychological milestone)

*Invest at your own risk, be careful and wag your tail!

The market is more volatile than expected, so it's important to manage risk carefully and make smart investment decisions.

Especially after major policy changes like this week, it takes time for the market to digest new information, so it's important to be patient and wait and see!

[Data source]

- Trading Economics (coffee prices, exchange rates)

- Barchart (ICE futures prices)

- Comunicaffe (market news, stock data)

- Somar Meteorologia (Brazilian meteorological data)

- Wise, Titan FX, Exchange-rates.org (Exchange rates)

- NBC News, Bloomberg, Washington Post, ABC News, PBS, Axios, CNN (Tariff Policy)

- Reuters, Nasdaq (stock data)

- Volcafe, Conab, USDA FAS (Production Forecast)

- NOAA (weather forecasting)

For the first half of the week, kids were running around the park excitedly, thinking, "Maybe we'll find some snacks!", but suddenly, in the middle of the week, the big news came in: "What?! There will be more snacks!?", and the market was shocked and astonished.

In the end, it was a very exciting week, filled with a mixture of excitement and anxiety!

Price Trend: A Big Jump and a Sudden Fall

At the start of the week, on Monday, November 3rd , ICE Arabica Coffee futures (December contract) rose to 406.65 cents . This was the highest price in two weeks, and it felt like I had jumped over a high fence!

The rise was due to concerns about drought in Brazil and falling ICE stocks, which led to worries that "snacks are running low!"

However, a major incident occurred on Wednesday, November 12th !

President Trump and Treasury Secretary Bennett announced that they would lower tariffs on coffee.

With this announcement, coffee prices plummeted to 403.65 cents (-4.5% from the previous day) . This was a shock, like "The snacks I was looking forward to suddenly came down from the sky!"

On Thursday, November 14 , President Trump officially announced tariff reductions on beef, coffee, and tropical fruits.

The price on that day fluctuated around 400.85 cents , and on Friday, November 14th, it fell a further -1.90 cents (-0.47%) .

Looking at the week as a whole, the price fell by about 6-7 cents (about 1.5-1.7%) from 406.65 cents to around 400 cents , showing that the news of the tariff reduction had a major impact on the market.

Why was it such a roller coaster ride? 5 reasons even a dog can understand

1. Trump Administration Announces Tariff Reductions (Super Big News):

On Wednesday, November 12 , Treasury Secretary Bennett announced that the U.S. would "significantly reduce tariffs on products not grown in the United States (such as coffee and bananas)."

It was officially held the following day, Friday, November 14th .

Until now, Brazilian coffee has been subject to a 50% tariff , but this is expected to be relaxed, and the market has responded with excitement, saying, "Maybe supply will increase!"

However, although framework agreements have been announced with Argentina, Guatemala, El Salvador, and Ecuador, high tariffs still remain on imports from Brazil and Colombia (more than 50% of the total) .

2. Severe drought in Brazil:

Brazil, the world's largest coffee producer, is experiencing its worst drought since 2025 .

In particular, the state of Minas Gerais saw one week in late October when only 0.3mm of rain fell (1% of normal levels) .

Reports from November 13th indicate that some key weeks continue to see only 1% of normal rainfall .

The drought occurred during the flowering season and could have a serious impact on the 2026/27 harvest.

It's like not being able to drink water during a long walk, and the coffee plants are feeling quite stressed.

3. ICE inventories at historic lows:

ICE (Intercontinental Exchange) certified Arabica coffee stocks fell to approximately 406,129 bags as of November 11 , the lowest level in 1.75 years (approximately 21 months) .

As of November 3rd, the number was 431,481 bags, so that's a decrease of about 25,000 bags in just one week!

This means that there is almost no snack in stock, which would normally push up prices.

Wang said the main reason for the inventory decline was that American buyers canceled new contracts for Brazilian coffee due to the 50% US tariff.

4. Downward revision of Brazilian production forecast:

Brazil's crop forecasting agency Conab has revised down its 2025 Arabica production to 35.2 million bags , down 4.9% from its May forecast.

Meanwhile, trading firm Volcafe forecasts a global arabica deficit of 8.5 million bags for the 2025/26 season .

This marks the fifth consecutive year of supply shortages , and the market is feeling anxious that "snacks are getting scarcer and scarcer!"

5. Risk of La Niña:

The National Oceanic and Atmospheric Administration (NOAA) has raised the probability of La Niña occurring in the Southern Hemisphere between October and December to 71% .

La Niña could bring excessive dryness to Brazil, further threatening the 2026/27 coffee harvest.

Good news and bad news

Good News

- US tariff cuts expected to ease some supply pressures

- The official announcement on November 14th may ease the impact on consumer prices sooner.

- Framework agreements with Argentina, Guatemala, El Salvador, and Ecuador

Bad News

- High tariffs still apply to imports from Brazil (over 50% of US imports) and Colombia

- The impact of the drought is structural, and tariff cuts alone cannot fully alleviate upward pressure on prices.

- ICE inventories remain at record lows, and supply remains tight

- Risk of La Niña phenomenon casts shadow over future harvests

- Global coffee stocks at 25-year low , market highly sensitive

The yen and dollar were in a "wait-and-see" mode.

The USD/JPY exchange rate remained relatively stable.

On Monday, November 10th , it traded at 154.127 yen , and on Tuesday, November 11th, it fell to a weekly low of 153.78 yen .

The one then rose to a weekly high of 154.945 yen on Wednesday, November 13th .

The weekly range was 153.78 yen to 154.945 yen , a fluctuation of approximately 1.17 yen .

This was a gentle movement, like "slowly walking back and forth on a stroll," in contrast to the violent fluctuations in the coffee market.

Although the yen's depreciation trend continues, no major direction has emerged, and the market is in a "wait-and-see" mode, watching the developments in Japanese and US monetary policies and the global economy.

The fall in coffee prices is softened in yen terms, which may have provided a bit of a cushion for Japanese importers.

This week's highlights (walking course)

1. Actual effects of tariff reductions:

It will be important to keep an eye on how much the tariff reductions announced by the Trump administration will actually affect prices.

However, the effect may be limited, as high tariffs still remain on imports from Brazil and Colombia (more than 50% of the total).

2. Rainfall in Brazil:

Rainfall patterns in Minas Gerais over the next few weeks will have a major impact on the flowering period for the 2026/27 season.

Although the weather forecast is promising improvement, it remains a concern at this time.

3. ICE inventory trends:

The focus is on whether ICE inventories, which are at historically low levels, will decline further or be replenished by tariff cuts.

4. Supreme Court ruling:

The Supreme Court is expected to rule on the Trump administration's tariffs, which could have a major impact on future trade policy.

5. Volcafe's latest report:

Leading analyst firm Volcafe is likely to release an updated report on the Brazilian drought and its impacts.

6. Vietnam Robusta Production:

Vietnam's coffee production is forecast to grow 6% to 1.76 million tonnes (29.4 million bags) in 2025/26, Wang said.

It will also be interesting to see how the increased supply of Robusta will affect the Arabica market.

Next week's predictions (with my dog's intuition at full force)

[Bullish scenario (420-430 cents)]

If rainfall in Brazil falls short of expectations and the drought worsens, markets could panic, with people thinking, "There really aren't enough snacks!"

Combined with the continued decline in ICE inventory, prices may test the 420-430 cent resistance zone.

If it becomes clear that the effects of tariff reductions are limited, there is a possibility that prices will return to an upward trend.

Bearish Scenario (380-390 cents)

If the impact of the tariff cuts is greater than expected and expectations of further policy easing grow, prices could fall to the support level of 380-390 cents .

Also, if there is more rain than expected in Brazil and the outlook for the 2026/27 harvest improves, selling pressure may increase on expectations that there may be more snacks available.

[Neutral scenario (400-410 cents)]

The most likely outcome is a flat movement within the 400-410 cent range.

The downward pressure from tariff cuts and the upward pressure from structural supply shortages are in balance, so the market is likely to continue in a "wait-and-see mode."

Fundamentals remain bullish, but policy uncertainty is likely to limit large price fluctuations in the short term.

[Foreign exchange market outlook]

We expect USD/JPY to move within the range of 153.50-155.50 yen .

Unless there are major changes in the monetary policies of Japan and the US, the current trend of a weak yen is likely to continue.

[Technical Analysis]

- Support levels: 380 cents, 390 cents, 395 cents

- Resistance levels: 410 cents, 420 cents, 430 cents

- Important pivot point: 400 cents (psychological milestone)

Risk factors

- Bad weather in Brazil (La Niña phenomenon)

- Additional changes in U.S. trade policy

- Supreme Court rulings on tariffs

- Declining demand due to a slowdown in the global economy

- Manabu risks (escalating trade friction)

- Impact of Vietnam's Robusta Supply Increase on the Arabica Market

*Invest at your own risk, be careful and wag your tail!

The market is more volatile than expected, so it's important to manage risk carefully and make smart investment decisions.

Especially after major policy changes like this week, it takes time for the market to digest new information, so it's important to be patient and wait and see!

[Data source]

- Trading Economics (coffee prices, exchange rates)

- Barchart (ICE futures prices)

- Comunicaffe (market news, stock data)

- Somar Meteorologia (Brazilian meteorological data)

- Wise, Titan FX, Exchange-rates.org (Exchange rates)

- NBC News, Bloomberg, Washington Post, ABC News, PBS, Axios, CNN (Tariff Policy)

- Reuters, Nasdaq (stock data)

- Volcafe, Conab, USDA FAS (Production Forecast)

- NOAA (weather forecasting)

If you want to enjoy coffee more deeply

" CROWD ROASTER APP"

Manabu at CROWD ROASTER LOUNGE

・Push notifications for article updates・Full of original articles exclusive to CROWD ROASTER

・Direct links to detailed information about green beans and roasters

App-only features

- Choose green beans and roasters to create and participate in roasting events・CROWD ROASTER SHOP: Everything from beans to equipment is readily available

・GPS-linked coffee map function